Broad-based rally pushes Nifty near 25,200 mark

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we take on a topic that often gets ignored but sits at the very foundation of markets — Trading & Investing Products. Every financial product is designed with a specific purpose in mind. Or, as we like to call it, the “horses for courses” problem. If you want to get better at trading or investing, you need to understand the toolkit available to you and what each tool is meant for.

We’ll go step by step through all the major products available in India - equities, debt, mutual funds, and derivatives, breaking down their role, their use cases, and how professionals and retail traders actually use them in practice.

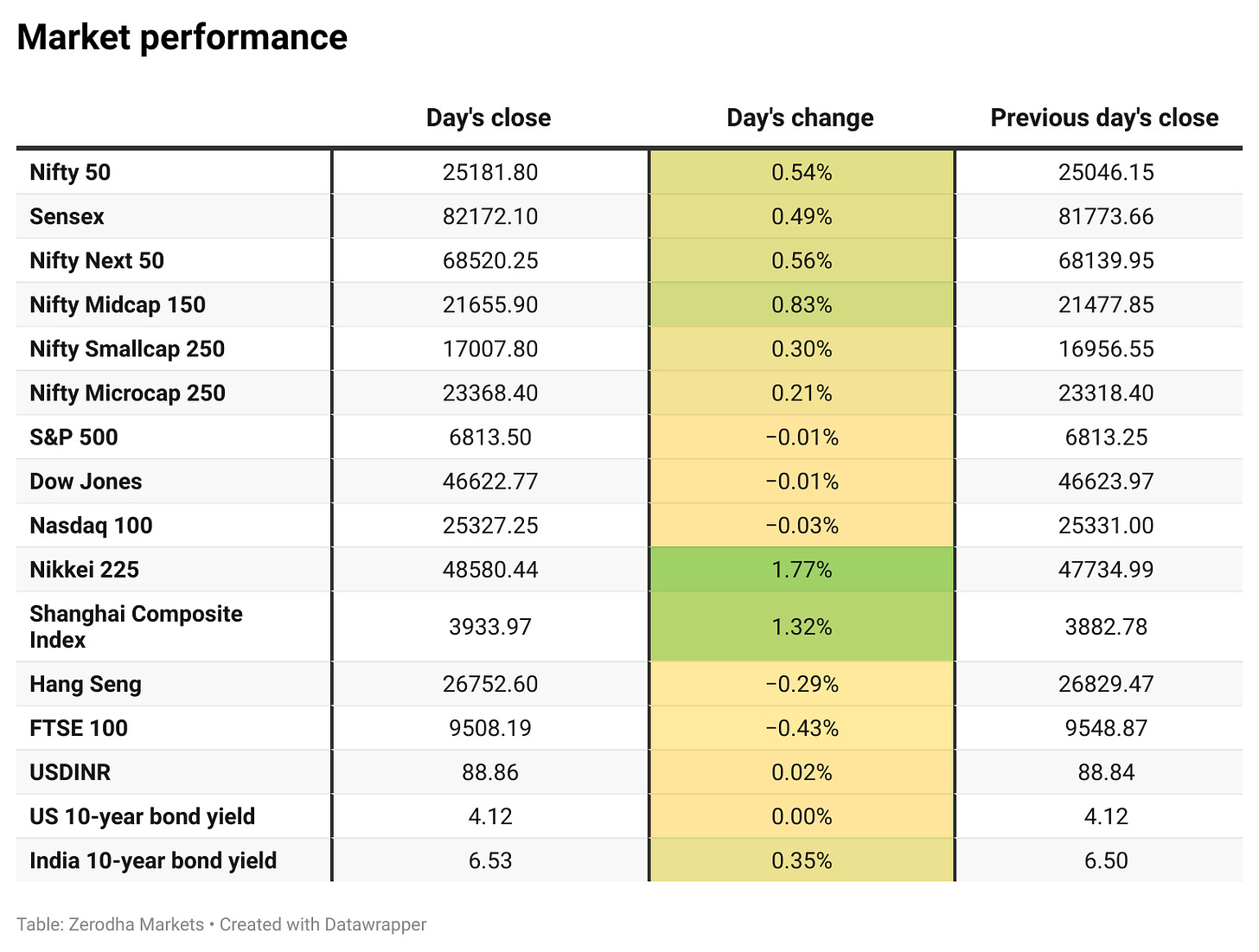

Market Overview

Nifty opened with a small gap-up of 30 points at 25,074 and slipped slightly in early trade, testing the 25,030 mark before finding support. The index then rebounded steadily through the morning session, reclaiming the 25,100 level and maintaining a positive bias.

Throughout the second half, the index traded within a narrow range between 25,120 and 25,180, consolidating its gains despite mild volatility. In the last hour, Nifty crossed the range and made a high of 25,199 before eventually closing at 25,181.80, up around 0.5%, marking a stable session with signs of improving sentiment across broader markets.

Market sentiment has once again turned cautious after tariffs on Pharma and a hike in H1-B visa fees affecting the IT sector. As we advance, investors will closely track the quarterly results starting today with TCS, festival season sales, and management commentary on demand trends across industries.

Broader Market Performance:

Broader markets had a mixed session with a slightly positive bias today. Of the 3,191 stocks traded on the NSE, 1,600 advanced, 1,495 declined, and 96 remained unchanged.

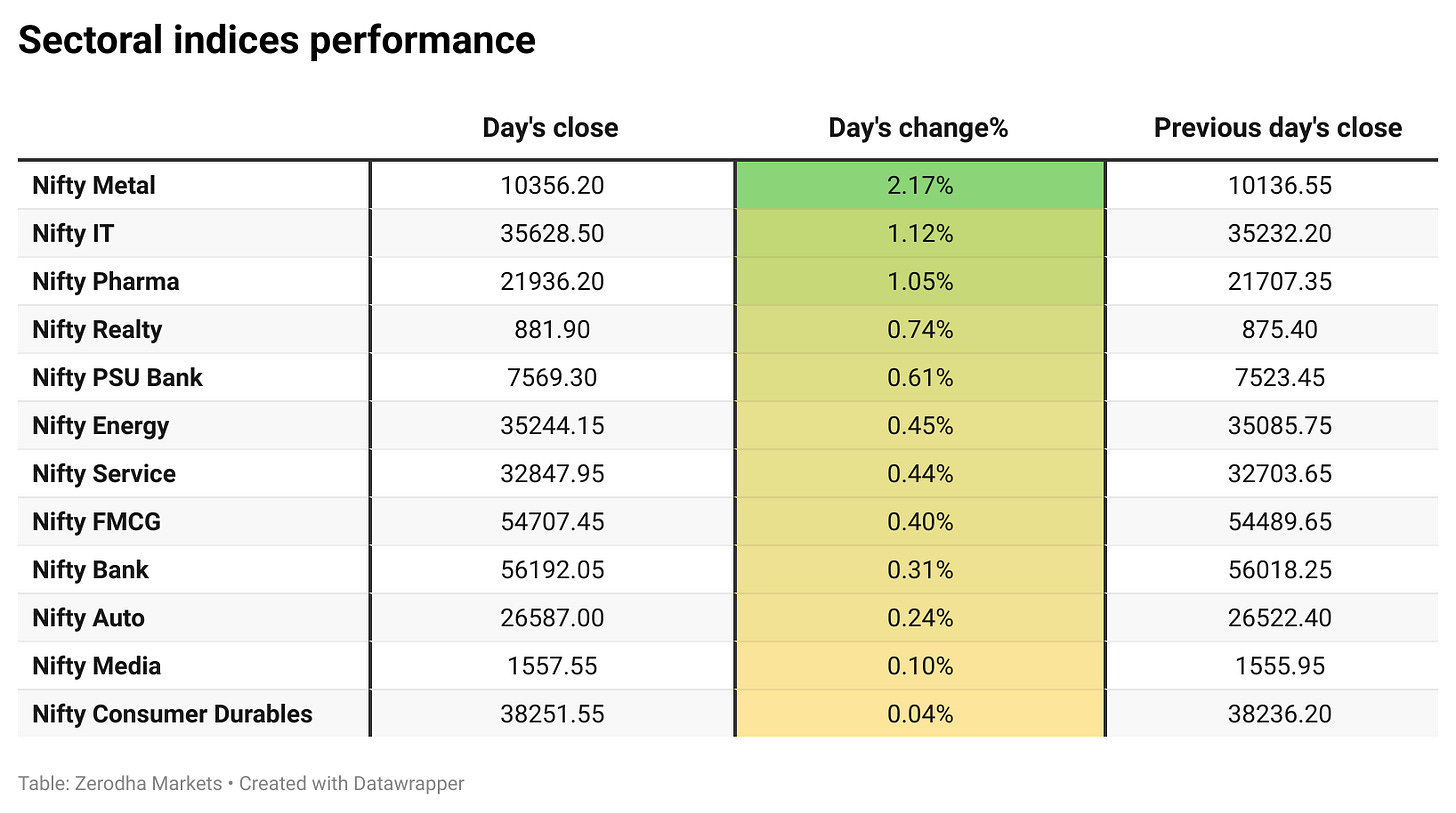

Sectoral Performance

The top gainer for the day was Nifty Metal, rising 2.17%, while Nifty Consumer Durables was the weakest performer, inching up just 0.04%. All 12 sectoral indices closed in the green, with no sector ending in red, reflecting broad-based market participation.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th October:

The maximum Call Open Interest (OI) is observed at 25,200, followed by 25,500, indicating potential resistance at the 25,300 -25,400 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed by 25,100, suggesting strong support at 25,100 to 25,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

TCS reported a 1.4% year-on-year rise in consolidated net profit to ₹12,075 crore for the September quarter. The company announced plans to become the world’s largest AI-led tech services firm, unveiling investments in a 1 GW AI datacentre in India and acquiring Salesforce partner ListEngage. It also declared a second interim dividend of ₹11 per share, with October 15 as the record date. Dive deeper

Larsen & Toubro (L&T) shares nearly 1% after its Hydrocarbon Onshore unit won an “ultra-mega” order worth over ₹15,000 crore in the Middle East to build a Natural Gas Liquids plant and associated infrastructure. Dive deeper

NPCI and Razorpay have partnered with Microsoft-backed OpenAI to introduce AI-driven payments on ChatGPT. The pilot program enables users to make purchases directly through India’s UPI network. Dive deeper

MosChip Technologies’ shares fell 4% after dropping as much as 9.2% intraday to ₹257.75 on the BSE. The decline came despite the launch of MosChip AgenticSky, a new suite of Agentic AI accelerators aimed at enabling adaptive, AI-driven product development across industries. Dive deeper

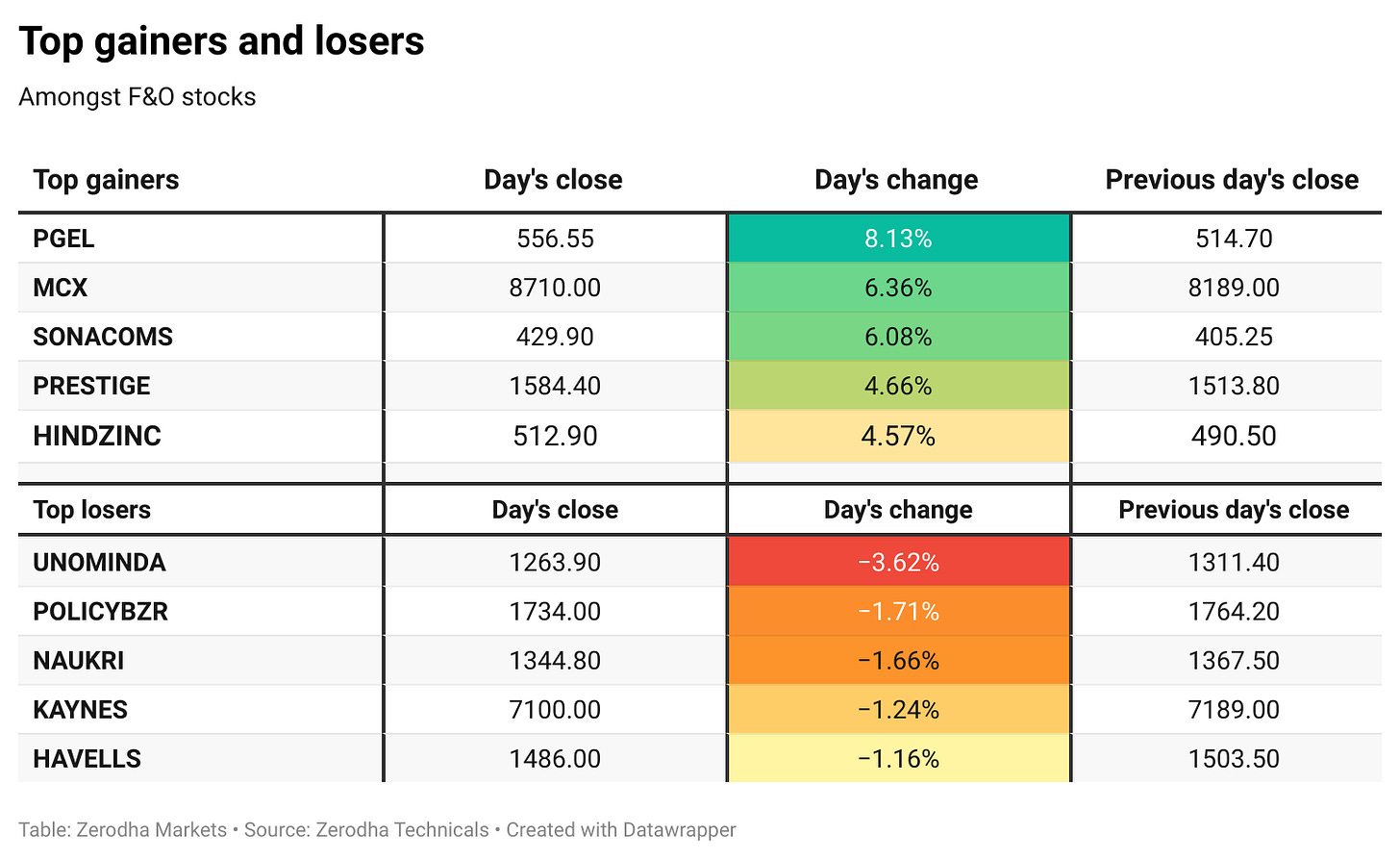

Tata Steel shares jumped nearly 2.5% after the European Commission proposed new measures to shield the EU steel sector from global overcapacity, which could favor export competitiveness for integrated producers like Tata. Dive deeper

The UK signed a £350 million (₹4,150 crore) defence pact with India to supply lightweight missiles, strengthening bilateral military ties. The deal coincides with PM Keir Starmer’s meeting with PM Narendra Modi and joint naval exercises in the Indian Ocean. Dive deeper

GM Breweries reported a strong Q2 FY26 performance with net profit rising 61% to ₹34.8 crore from ₹21.6 crore a year earlier. Revenue grew 20.5% to ₹181 crore, while EBITDA surged 62% to ₹45 crore. Dive deeper

What’s happening globally

Wall Street futures remained muted ahead of Fed Chair Powell’s upcoming remarks, as markets await his view on inflation and the labor market to gauge the next rate direction. Dive deeper

Japan’s Nikkei 225 hit a record high, driven by a sharp rally in SoftBank, which gained on renewed optimism around AI and cloud growth. Dive deeper

Gold prices paused after a strong rally, holding above $4,000 per ounce as markets weighed the Israel-Hamas ceasefire deal. Persistent geopolitical and economic uncertainties, plus expectations of U.S. rate cuts, continue to underpin the metal. Dive deeper

U.S. container imports fell 8.4% in September year-on-year, with shipments from China plunging 22.9%, as Trump’s tariff regime and front-loading of orders ahead of rate hikes disrupt global trade flows. Dive deeper

European shares dipped after reaching record highs, with banking stocks under pressure. HSBC fell 6.5% following its proposal to privatise its Hong Kong unit Hang Seng Bank, dragging the STOXX 600 lower. Dive deeper

Maersk shares plunged to a three-month low after reports of a potential Gaza ceasefire raised expectations that the Red Sea, and thus the Suez Canal route might reopen, which could soften freight rates by easing the shipping bottleneck. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

CS Setty, Chairman, SBI, on acquisition financing and Expected Credit Loss (ECL) Framework

“I think banks like SBI are well versed in acquisition financing.”

“The long transition time that is given, we believe that there will be limited impact on the balance sheet of banks,” - Link

Aarthi Subramanian, Chief Operating Officer, TCS, on the acquisition of ListEngage, Salesforce Summit partner

“This US-based acquisition is an important step in scaling our Salesforce capabilities globally. ListEngage’s AI advisory services, Marketing Cloud capabilities and Agentforce expertise will enhance our offerings and execution to serve the needs of marketing stakeholders in enterprises. This acquisition will further deepen the strategic partnership that TCS has with Salesforce. We welcome ListEngage’s talented team to TCS.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

Hi, your aftermarket report via mail is offering all the good news at one place, but i would like you to add FII-DII of the current day, because anyway you are sending after the markets hours, if you could wait for that data and integrate into your mail will be even more value additipon.