Another late-session slide pushes Nifty under 25,900

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

In our latest episode of In The Money by Zerodha video series, we explore how Week 47 of 2025 turned into one of the strongest stretches for Indian equities, powered by the sharpest earnings recovery in over a year. NIFTY and SENSEX nearly reclaimed new highs after a long 14-month wait, while BANKNIFTY and MIDCPNIFTY broke into fresh all-time-high territory. Sentiment stayed firmly bullish overall, though a late-week wobble in US markets now raises the question of whether India will have to absorb some global volatility in the days ahead.

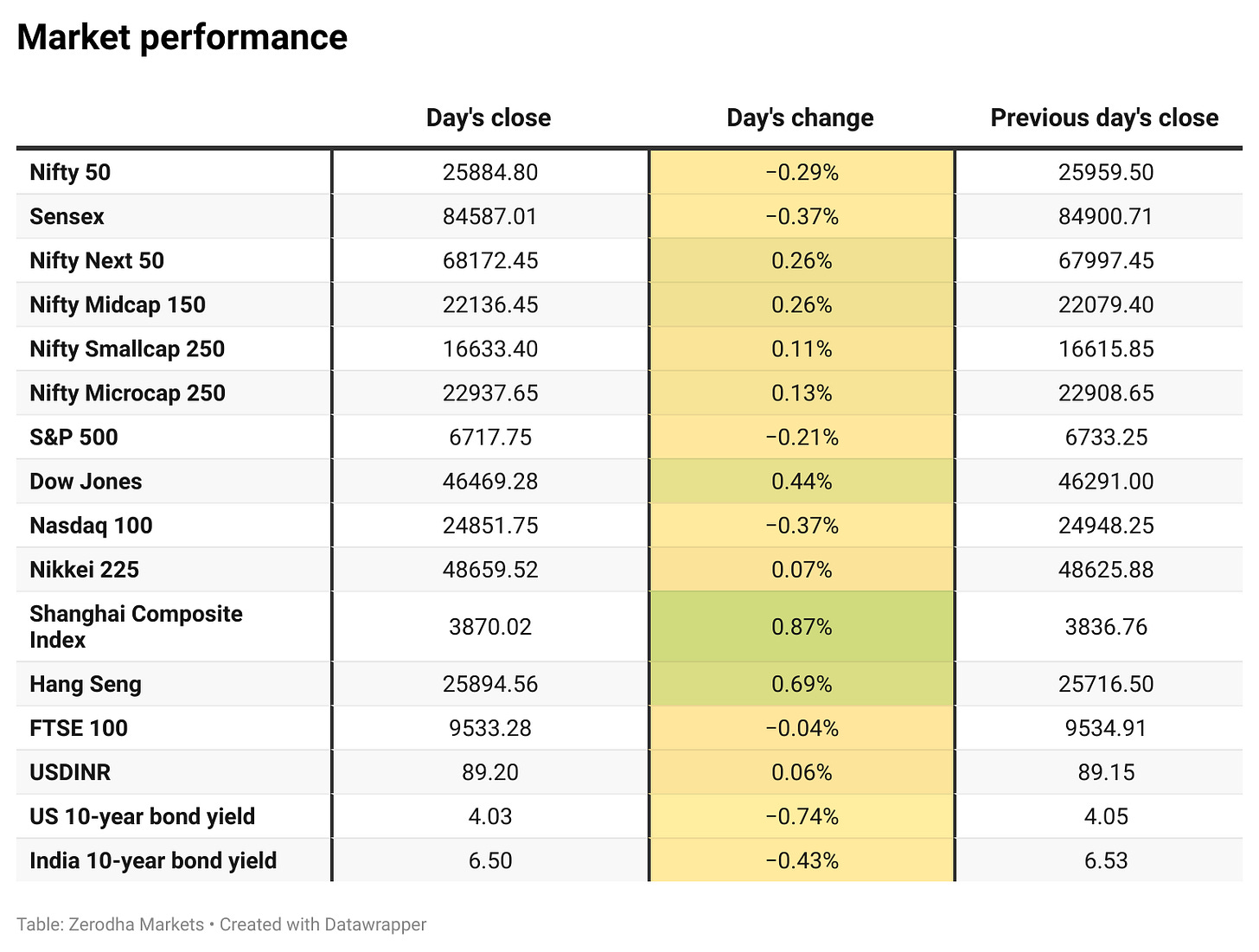

Market Overview

Nifty opened with a gap-up of 40 points at 25,999, but the early strength faded quickly as the index slipped toward the 25,940–25,960 zone within the first 30 minutes. Through the late morning, Nifty tried to stabilise but stayed largely range-bound between 25,970 and 26,000, reflecting a lack of decisive intraday momentum.

Early afternoon saw a mild recovery toward 26,020–26,030, but buying interest remained weak. After 2 PM, selling pressure returned, pulling the index steadily lower toward 25,950, before a sharp drop in the final 45 minutes dragged it to the 25,860 zone. Nifty eventually closed near the day’s low at 25,884.80, down nearly 0.3%, marking a subdued, directionless session dominated by late-day selling.

Looking ahead, markets are likely to remain sensitive to developments around the India–U.S. trade deal, along with broader global cues.

Broader Market Performance:

The broader markets had a mixed session today. Of the 3,214 stocks traded on the NSE, 1,640 advanced, 1,472 declined, and 102 remained unchanged.

Sectoral Performance:

The top-gaining sector for the day was Nifty Realty, which rose by 1.62%, while Nifty Media was the top laggard, falling 0.80%. Out of the 12 sectoral indices, 4 closed in the green and 8 ended in the red, indicating a broadly negative sectoral trend despite a few bright spots.

Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd December:

The maximum Call Open Interest (OI) is observed at 26,000, followed by 26,200, indicating potential resistance at the 26,100 -26,200 levels.

The maximum Put Open Interest (OI) is observed at 26,000, followed by 25,500, suggesting support at the 25,800 to 25,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff, like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

India’s 10-year G-Sec yield hovered near 6.5%, its highest since April, as markets weighed the government’s upcoming reform-focused winter session, which includes bills aimed at boosting investment. Dive deeper

India’s Russian oil imports are expected to drop to a three-year low in December, falling to about 600,000–650,000 barrels per day, according to Reuters. State refiners have shifted to alternative supplies amid tighter bank scrutiny and concerns over breaching Western sanctions following new U.S. trade tariffs. Dive deeper

Sobha Ltd has made its entry into the Mumbai housing market with the launch of a project comprising 310 flats, marking its expansion beyond its traditional strongholds. Dive deeper

India has imported a record 150,000 tonnes of soybean oil from China, a notable shift from its usual suppliers, as Chinese crushers unload surplus stock from weak domestic demand and offer discounts of $15–$20 per ton. Dive deeper

Spandana Sphoorty Financial closed 1.5% higher after announcing the appointment of Venkatesh Krishnan as its new Managing Director and CEO, effective November 27. He previously led the microfinance business at HDFC Bank. Dive deeper

What’s happening globally

Brent crude pared gains and fell toward $63 as Russia-Ukraine peace talks progress, raising expectations of eased sanctions on Russian oil. Dive deeper

US stock futures held steady after Monday’s tech-driven rally, with the Dow (+0.44%), S&P 500 (+1.55%), and Nasdaq (+2.69%) gaining on renewed Fed rate-cut expectations. Dive deeper

Amazon.com is planning to invest about $15 billion in Northern Indiana to build data center campuses as it expands cloud capacity to meet soaring AI demand. The project, in addition to the $11 billion announced last year, will add 2.4 gigawatts of capacity and is expected to create 1,100 jobs. Dive deeper

European indices (STOXX 50 and STOXX 600) hovered near flatline on Tuesday, with consumer discretionary and travel stocks dragging while defense names gained. Dive deeper

Hong Kong’s October trade deficit widened to $39.9 billion from $31.0 billion year-ago, as imports grew 18.3% and outpaced export growth of 17.5%. Dive deeper

Management chatter

In this section, we highlight interesting comments made by the management of major companies and policymakers from the Indian and Global Economies.

Reserve Bank of India (RBI) Governor Sanjay Malhotra, on rate cuts

“At the October meeting of the Monetary Policy Committee (MPC), it was indicated that there is a scope for a further rate cut in the (monetary) policy. None of the macro indicators, including inflation, released after that (post October MPC meeting), suggest that the scope (for rate cut) has reduced. So, there is definitely a scope (for a rate cut), but MPC will decide on it in the upcoming meeting,” - Link

Sudip Bandyopadhyay on Indian markets amid global AI turbulence & India-US trade deal focus

“Indian equities have held their ground despite global AI-led turbulence and worries around U.S. tech, reflecting underlying market resilience.”

“Markets are increasingly focused on the potential India–U.S. trade deal, which could boost investor confidence and India’s economic outlook.”

“Strong domestic fundamentals are helping absorb external shocks, even as global data remains erratic and trade deal clarity is awaited.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

So, we’re now on Reddit!

We love engaging with the perspectives of readers like you. So we asked ourselves - why not make a proper free-for-all forum where people can engage with us and each other? And what’s a better, nerdier place to do that than Reddit?

So, do join us on the subreddit, chat all things markets and finance, tell us what you like about our content, and where we can improve! Here’s the link — alternatively, you can search r/marketsbyzerodha on Reddit.

See you there!

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

crazy afternoon sessions recently